4 Oil & Gas Earnings to Watch on Oct 29: COG, DVN, COP & NFE

We are entering the thick of the Q3 earnings season for Oil/Energy, with a host of companies, including ExxonMobil XOM and Chevron CVX, expected to come out with results by the end of this week. Before going into the details of the upcoming releases, let’s take a look at the factors affecting the quarterly results and the report card so far.

Commodity Prices Drop Versus Year-Ago Period

Investors should know that there is a high correlation between commodity price and the earnings of energy companies.

So, how does the price of oil and gas compare with the year-ago period?

Collapsing commodity prices and demand are likely to have played foul on the sector’s top and bottom lines with negative year-over-year growth expected on both fronts. While things got quite ugly in the second quarter with the full impact of the coronavirus pandemic when crude plunged into negative territory briefly, the July-September period should offer comparatively better returns on gradually tightening fundamentals.

According to the U.S. Energy Information Administration, in July, August and September of 2019, the average monthly WTI crude price was $57.35, $54.81 and $56.95 per barrel, respectively. This year, average prices were much lower — $40.71 in July, $42.34 in August and $39.63 in September.

The news is not rosy on the natural gas front either. In Q3 of last year, U.S. Henry Hub average natural gas prices were $2.37 per MMBtu in July and fell to $2.22 in August before recovering to $2.56 in September. Coming to 2020, the fuel was trading at $1.77, $2.30 and $1.92 per MMBtu, in July, August and September, respectively.

Most Companies Hit by Lower Prices, Signs of Green Shoots

Taking into account the sharp drop in commodity price, the picture looks rather downbeat for the Q3 earnings season.

Per the latest Earnings Trends, energy is likely to have experienced big top and bottom-line decline from a year earlier. Per our expectations, the sector’s earnings are likely to have slumped 113.9% from third-quarter 2019 on 30.4% lower revenues.

Over the past three months, oil price has been essentially hovering around the $40-a-barrel mark. With this firmed-up price and some previously shut-in production coming back online, some operators could surprise on the upside. It’s a price that incentivizes them to bring back some of their voluntary production cuts, leads to improved cash flows and increase chances of an earnings beat.

For the few S&P 500 companies that have already reported, total earnings are down 64.7% from the same period last year on 35.4% lower revenues, with 66.7% positive earnings surprises and 33.3% beating revenue estimates.

Key Releases

Given the bleak year-over-year backdrop, let’s take a glance at how four energy players are placed ahead of their third-quarter results slated for release on Oct 29.

Our proprietary model clearly indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

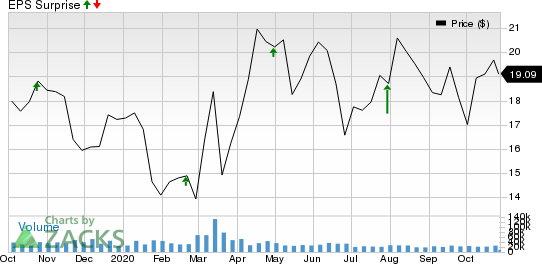

Cabot Oil & Gas Corporation COG: This natural gas producer is slated to report quarterly results after the closing bell. The company came up with an earnings beat in the last-reported quarter due to higher-than-anticipated production volumes. As far as earnings surprises are concerned, Cabot beat the Zacks Consensus Estimate in three of the last four quarters and met in the other, delivering an earnings surprise of 20.44%, on average. This is depicted in the graph below:

Cabot Oil Gas Corporation Price and EPS Surprise

Cabot Oil Gas Corporation price-eps-surprise | Cabot Oil Gas Corporation Quote

The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 7 cents per share on revenues of $347 million. This indicates year-over-year earnings and revenue decline of 75.9% and 19.1%, respectively.

Our proven model does not conclusively predict an earnings beat for Cabot this time around, as it has an Earnings ESP of 0.00% and a Zacks Rank #2. (What's in the Cards for Cabot This Earnings Season?)

Devon Energy Corp. DVN: The company, whose oil and gas operations are mainly concentrated in the onshore areas of North America, is slated to report quarterly results after the closing bell. The company — in the process of a $2.6 billion merger agreement with WPX Energy WPX — came up with better-than-expected bottom-line performance in the last reported quarter on strong production and cost-control initiatives. As far as earnings surprises are concerned, Devon Energy is on an excellent footing, having gone past the Zacks Consensus Estimate in each of the last four reports, with the average surprise being 63.41%. This is depicted in the graph below:

Devon Energy Corporation Price and EPS Surprise

Devon Energy Corporation price-eps-surprise | Devon Energy Corporation Quote

The current Zacks Consensus Estimate for the to-be-reported quarter is a loss of 8 cents per share on revenues of $1.1billion. This indicates a year-over-year earnings and revenue decline of 130.8% and 42.3%, respectively.

Our proven model predicts an earnings beat for Devon Energy this time around, as it has an Earnings ESP of +23.99% and a Zacks Rank #3. (What's in the Cards for Devon Energy's Q3 Earnings?)

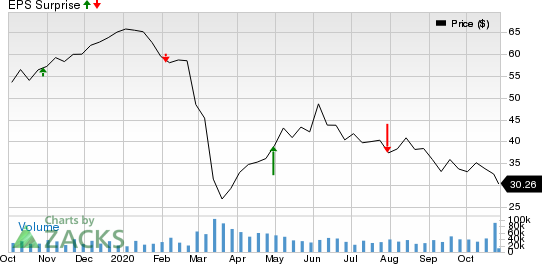

ConocoPhillips COP: ConocoPhillips, which has strong presence across conventional and unconventional plays in 16 countries, is set to report quarterly results before the opening bell. In the last reported quarter, the Houston, TX-based company missed the consensus mark due to lower realized commodity prices and production volumes. Regarding earnings surprises, the upstream major, which recently confirmed its decision to take over Concho Resources CXO ifor $9.7 billion, beat the Zacks Consensus Estimate in two of the last four quarters and missed in the other two, delivering an earnings surprise of 12.96%, on average. This is depicted in the graph below:

ConocoPhillips Price and EPS Surprise

ConocoPhillips price-eps-surprise | ConocoPhillips Quote

The current Zacks Consensus Estimate for the to-be-reported quarter is a loss of 33 cents per share on revenues of $4.4billion. This indicates a year-over-year earnings and revenue decline of 140.2% and 56.4%, respectively.

Our proven model does not conclusively predict an earnings beat for ConocoPhillips this time around, as it has an Earnings ESP of +6.63% and a Zacks Rank #4 (Sell). (What's in the Cards for ConocoPhillips' Q3 Earnings?)

New Fortress Energy Inc. NFE: New Fortress Energy, a natural gas company providing logistical solutions, is set to unveil quarterly results before the opening bell. In the last reported quarter, the firm missed the consensus mark due to weak LNG volumes and higher costs. As far as earnings surprises are concerned, New Fortress Energy displays a dismal trend, having underperformed the Zacks Consensus Estimate in each of the last four reports, with the average surprise being -40.22%. This is depicted in the graph below:

New Fortress Energy LLC Price and EPS Surprise

New Fortress Energy LLC price-eps-surprise | New Fortress Energy LLC Quote

The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 18 cents per share on revenues of $145.8million. This indicates year-over-year earnings and revenue growth of 160% and 193.6%, respectively.

Our proven model does not conclusively predict an earnings beat for New Fortress Energy this time around, as it has an Earnings ESP of 0.00% and a Zacks Rank #3.

Zacks’ 2020 Election Stock Report:

In addition to the companies you learned about above, we invite you to learn more about profiting from the upcoming presidential election. Trillions of dollars will shift into new market sectors after the votes are tallied, and investors could see significant gains. This report reveals specific stocks that could soar: 6 if Trump wins, 6 if Biden wins.

Check out the 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Cabot Oil Gas Corporation (COG) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

WPX Energy, Inc. (WPX) : Free Stock Analysis Report

New Fortress Energy LLC (NFE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research