3M's (MMM) Arm Unveils SoluPrep S Sterile Antiseptic Solution

3M Company MMM arm 3M Health Care recently launched 3M SoluPrep S Sterile Antiseptic Solution. The product is a chlorhexidine gluconate (2% w/v) and isopropyl alcohol (70% v/v) Patient Preoperative Skin Preparation solution.

The SoluPrep S Sterile Antiseptic Solution provides swift broad-spectrum antimicrobial activity (in vitro) and has shown consistency in healthy human volunteers for a minimum of 96 hours post-prep. It helps users assure that the surgical prep area is completely covered. Its applicator is easy to use and covers more area in comparison to the CHG/IPA surgical prep product, which has the same size applicator. Also, the applicator can be activated easily and during application, its foam sponge reduces drips by controlling the ???ow of the solution. The solution has an ingredient that can advance incise drape adherence.

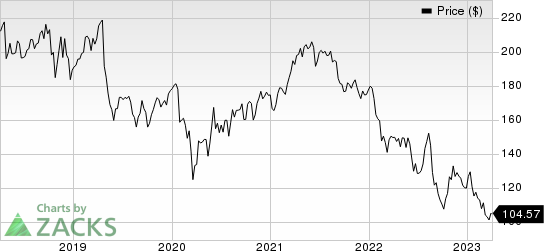

3M Company Price

3M Company price | 3M Company Quote

The product is suitable for use by O.R. (Operations Research) nurses, surgeons and infection preventionists who intend to prepare patient skin safely, efficiently and confidently before surgery to reduce bacteria on the skin that can likely cause skin infection. In the U.S., the 3M SoluPrep S Sterile Antiseptic Solution will be commercially available in a limited amount from Apr 3, 2023. Its complete commercial launch will begin in 2024.

Zacks Rank and Other Stocks to Consider

MMM currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Some other top-ranked companies are discussed below:

Deere & Company DE presently sports a Zacks Rank #1. DE’s earnings surprise in the last four quarters was 4.7%, on average.

In the past 60 days, estimates for Deere & Company’s fiscal 2023 earnings have increased by 8.6%. The stock has rallied 16.6% in the past six months.

General Electric Company GE presently sports a Zacks Rank #2. GE’s earnings surprise in the last four quarters was 27.9%, on average.

In the past 60 days, estimates for General Electric’s 2023 earnings have increased by 2.6%. The stock has gained 43.7% in the past six months.

A. O. Smith Corporation AOS presently carries a Zacks Rank #2. AOS’ earnings surprise in the last four quarters was 3.2%, on average.

In the past 60 days, estimates for A. O. Smith’s 2023 earnings have increased by 4.7%. The stock has gained 33.6% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report