3 Top-Ranked, Top Performing S&P 500 Stocks

The stock market performance has surprised many investors this year. Coming into 2023 analysts were expecting a recession, and many participants were forecasting another challenging year for the stock market.

While the market indexes have rallied nicely this year especially since the banking crisis in mid-March, much of the performance has been in a few leading stocks. I will cover three stocks that fall in the top ten performers of the S&P 500 and are Zacks Rank #1 (Strong Buy) stocks, further improving the odds of near-term strong performance.

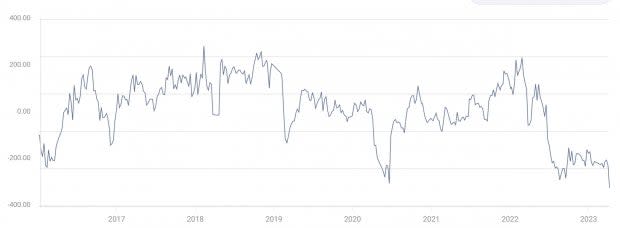

There is an additional bullish catalyst that I think is worth noting as well. The chart below is a net positioning chart from the CFTC, also called Commitment of Traders (COT). This data shows the outstanding long and short positions in specific futures markets. This one shows the net positioning of large speculators in S&P 500 futures, and it shows large net short positions. We can see that large speculators like hedge funds have their largest net short position in years. This data alone doesn’t tell us if we should be outright bullish or bearish, but it is valuable.

If you look back in the data, you’ll see that when net short positioning gets stretched, like it is today, the market often rallies. Speculators get too bearish and the market rallies to shake them. This means that based on the current data, it’s very possible there is more upside to come in equity markets.

Image Source: CFTC

Meta Platforms

Meta Platforms META is the #1 performing stock in the S&P 500 boasting an 83% return YTD. It is also a Zacks Rank #1 (Strong Buy) stock, indicating upward trending earnings revisions.

Analysts have upgraded the current quarter earnings by 2% over the last 60 days, while FY23 and FY24 earnings have been revised higher by 11% and 14% respectively. User growth across Meta’s platforms as well as increased engagement has reassured investors and boosted the stock price.

Additionally, tough decisions like large-scale layoffs and a major restructuring have demonstrated to investors that CEO Mark Zuckerberg is willing to prioritize profits and shareholders.

Image Source: Zacks Investment Research

META is trading at a one-year forward earnings multiple of 22x, which is above the market average but well below its 10-year median of 30x. META’s valuation got as low as 10x earnings at the end of 2022.

Image Source: Zacks Investment Research

Salesforce

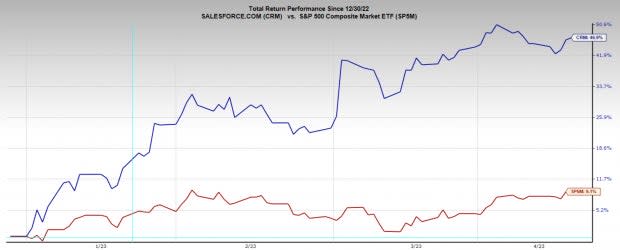

Salesforce CRM, like Meta, has undergone a massive restructuring over the last six months, laying off 8,000 employees, which is 10% of its workforce. Also, like Meta, investors have responded positively to the changes. The share price is up 47% YTD, making it the seventh strongest stock in the index.

Image Source: Zacks Investment Research

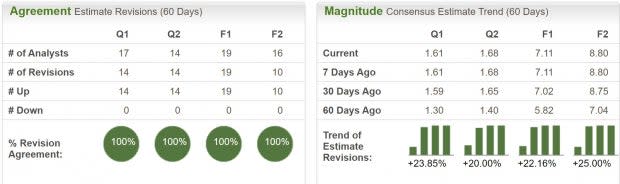

Even after all the improvement and stock appreciation, analysts are still upgrading their estimates for Salesforce earnings. CRM stock currently has a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Earnings estimates have been revised higher by a minimum of 20% across timeframes.

Image Source: Zacks Investment Research

Salesforce is trading at a one-year forward earnings multiple of 40x, which is above the industry average 30x, and well below its three-year median of 100x. CRM continue to benefit from the secular trend of digital transformation, and sales are expected to grow 10% annually over the next two years.

Image Source: Zacks Investment Research

General Electric

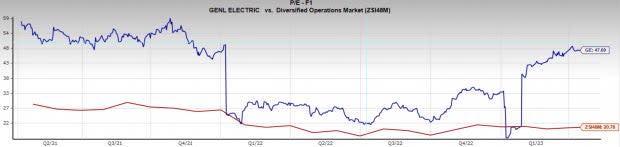

A surprising addition to the top stocks of 2023 is General Electric GE. General Electric is one of the leaders of the past, but near-term expectations are strong, and clearly investors have been favoring the stock. GE is the eighth best performing stock in the S&P 500, up 44% YTD.

In the chart below we can see GE has experienced a considerable fall in popularity, and thus stock price. The stock is still -75% off its all-time high from back in 2000. But that doesn't mean it can’t be a good stock again. It has found support at the prior low of $40 and shows strong upside momentum.

Image Source: TradingView

Additionally, earnings are being revised higher, giving GE a Zacks Rank #1 (Strong Buy). Current quarter and next quarter earnings are flat to up, but FY23 have been revised slightly higher, and FY24 expectations have climber 20%. Strong performance of the Aerospace segment has been the primary driver for GE’s sales growth, and the continued strong trend in the recovery bodes well for the stock.

Image Source: Zacks Investment Research

GE is trading at a one-year forward earnings multiple of 48x, well above the market average of 21x, and above its two-year median of 34x. One of the big risks for GE currently is its renewables segment. Lat quarter sales from renewables showed a decline of -19% YoY and were hurt by lower U.S. onshore wind volumes.

Image Source: Zacks Investment Research

Bottom Line

This year has been full of surprises. If there is one lesson from this year’s action, it is that investors must remain flexible. Getting stuck on a narrative and being unwilling to shift to changing market environments is an extremely dangerous trait. But if investors can be open-minded and objective about the data, they will be rewarded handsomely.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report