3 Red-Hot Tech Stocks With Big Growth

With the first half of 2023 wrapping up, one thing is certain – it’s been a great year to be an investor, specifically for those with technology exposure.

Several stories have gripped the market throughout the year: banking concerns, questions surrounding the Federal Reserve’s future path of rate hikes, and Wall Street’s shiny new toy, artificial intelligence (AI).

Many analysts have turned bullish on stocks, and the story is particularly true for Nvidia NVDA, Salesforce CRM, and Palo Alto Networks PANW. All three sport a favorable Zacks Rank, indicating optimism surrounding their current outlooks.

In addition, all three are forecasted to witness significant growth. Let’s take a closer look at each.

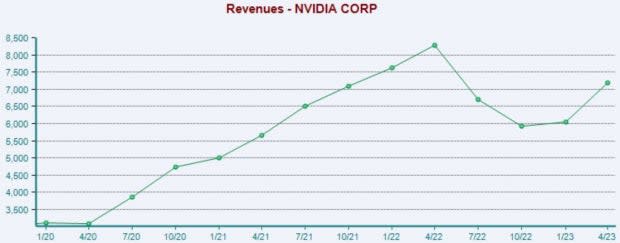

Nvidia

NVDA shares have delivered a remarkable performance since their 2022 October lows, up more than 250%. The company’s Artificial Intelligence (AI) operations have become a big focus among investors, with buyers consistently stepping up to get exposure to Wall Street’s shiny new toy.

As we all know, the company shocked the entire market following its blowout quarter, posting results well above expectations and providing bullish revenue guidance. Nvidia upped its revenue guidance for its 2024 Q2 to $11 billion, well above previous expectations.

Image Source: Zacks Investment Research

Another bright highlight in the quarter came from NVDA’s Data Center segment, which includes AI operations. Data Center posted record revenue of $4.3 billion, climbing an impressive 14% from the year-ago quarter and 9% above the Zacks Consensus Estimate.

Following the blowout quarter, analysts have become notably bullish on the company’s outlook, with earnings expectations jumping across all timeframes. The stock is a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Impressively, the company is now expected to post 130% earnings growth in its current fiscal year (FY24) on 60% higher revenues.

Salesforce

Salesforce, a Zacks Rank #1 (Strong Buy), is the leading provider of on-demand Customer Relationship Management (CRM) software. Shares had a brutal 2022 but have stopped for little in 2023, up nearly 60%.

The company has enjoyed positive earnings estimate revisions across the board, with the revisions trend particularly noteworthy for its upcoming quarterly release expected in late August. CRM posted results above expectations in its latest release, reporting 11% revenue growth and positive results across all segments.

Image Source: Zacks Investment Research

CRM’s growth is slated to continue, with estimates calling for 42% earnings growth on 11% higher revenues in its current fiscal year (FY24). And looking ahead to FY25, estimates allude to 21% earnings growth on 11% higher sales.

Image Source: Zacks Investment Research

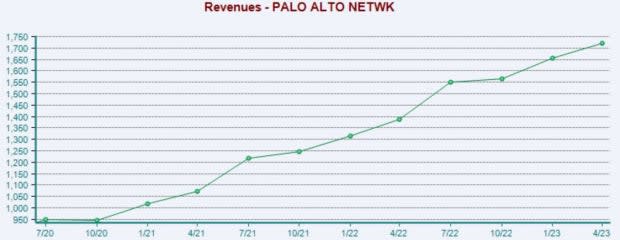

Palo Alto Networks

Cybersecurity titan Palo Alto Networks posted results that impressed the market in its latest release, with shares seeing an 8% jump post-earnings in the following trading session. The stock is a Zacks Rank #1 (Strong Buy), with analysts taking their expectations higher across the board.

Image Source: Zacks Investment Research

Further, the company updated its cash flow margin and operating guidance due to its focus on profitability, which is undoubtedly a positive. PANW also expects FY23 revenues in a range of $6.88 - $6.91 billion, with the midpoint reflecting 23.5% year-over-year growth.

The company’s top line growth has been rapid, further illustrated below.

Image Source: Zacks Investment Research

Regarding earnings, the $4.27 Zacks Consensus EPS Estimate suggests growth of nearly 70% year-over-year for its current fiscal year. In FY24, estimates suggest a further 17% of earnings growth.

Bottom Line

With the Nasdaq delivering an unbelievable first half, those with patience have been rewarded handsomely in 2023, enjoying serious gains.

And all three tech heavyweights above – Nvidia NVDA, Salesforce CRM, and Palo Alto Networks PANW – have seen their earnings outlooks drift significantly higher amid the optimism and other market-friendly developments.

In addition, all three carry impressive growth projections, making them solid considerations for any investor with a growth-focused mindset.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report