3 Reasons to Retain PacBio (PACB) Stock in Your Portfolio

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, is well-poised for growth in the coming quarters, courtesy of its slew of strategic deals over the past few months. The optimism led by a solid fourth-quarter 2022 performance, along with its product development activities, is expected to contribute further. However, stiff competition and production bottlenecks persist.

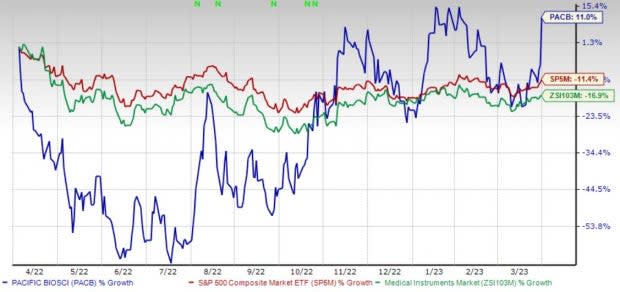

Over the past year, this Zacks Rank #3 (Hold) stock has gained 11% against the 16.9% decline of the industry and 11.3% fall of the S&P 500.

This renowned global provider of sequencing systems has a market capitalization of $2.86 billion. The company projects 10.1% growth for 2023 and expects to maintain a strong performance. PacBio’s projected sales growth of 34.8% is favorable compared with the industry’s 9%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strategic Deals: We are optimistic about PacBio’s robust growth opportunities via its inking of a slew of strategic deals over the past few months. In January, the company announced a collaboration with the University of Tokyo, Graduate School of Medicine, to study the use of long-read sequencing and novel bioinformatics methods to better understand the genetic causes of certain rare diseases in individuals and cohorts within the Japanese population.

The company, in December 2022, announced that its HiFi sequencing technology would be used in a pilot project for the Children’s Rare Disease Cohorts Initiative at Boston Children’s Hospital.

Product Development Activities: We are optimistic about PacBio's solid potential in the RNA-sequencing market, which has been fortifying the company’s footprint worldwide. In March, PacBio announced new workflows developed with global agriculture company, Corteva Agriscience, enabling high throughput plant and microbial genome sequencing.

On the fourth-quarter 2022 earnings call in February, PacBio’s management confirmed that it expects to witness many Sequel II and IIe users to migrate to Revio during 2023.

Strong Q4 Results: PacBio saw a robust increase in its Consumables revenues during the fourth quarter of 2022. Robust performance in the Asia-Pacific region was also seen. Continued strong prospects for the company’s Revio and Onso systems, with customers placing orders, were also recorded. The recent launch of the Paraphrase tool, confirmed during the fourth-quarter earnings call, augurs well.

Downsides

Production Bottlenecks: PacBio must successfully manage new product introductions and transitions, including the Single Molecule, Real-Time Cell 8M and Sequel II/IIe Systems. However, the company may incur high costs during these transitions, which may not result in the anticipated benefits.

Stiff Competition: PacBio operates in a highly competitive market where its competitors offer nucleic acid sequencing equipment or consumables. Many of these companies currently have greater resources and may be able to respond more quickly and effectively than PacBio to new or changing opportunities, technologies, standards or customer requirements.

Estimate Trend

PacBio has been witnessing a positive estimate revision trend for 2023. Over the past 90 days, the Zacks Consensus Estimate for its loss per share has narrowed from $1.32 to $1.24.

The Zacks Consensus Estimate for the company’s first-quarter 2023 revenues is pegged at $35.2 million, suggesting a 6.1% uptick from the year-ago quarter’s reported number.

This compares to our first-quarter revenue estimate of $34.7 million, suggesting a 4.6% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Henry Schein, Inc. HSIC and Avanos Medical, Inc. AVNS.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 15.2%. HOLX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 30.6%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 6% against the industry’s 16.9% decline in the past year.

Henry Schein, sporting a Zacks Rank #1 at present, has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in the other, the average beat being 2.9%.

Henry Schein has lost 7% compared with the industry’s 4.9% decline over the past year.

Avanos, carrying a Zacks Rank #2 at present, has an estimated growth rate of 1.8% for 2023. AVNS earnings surpassed estimates in all the trailing four quarters, the average beat being 11%.

Avanos has lost 11.5% compared with the industry’s 16.9% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report