These 3 Blue-Chip Stocks Are Great Shields Against Volatility

Over the last week, many stocks have pulled back on fears of interest rate hikes. During times of heightened uncertainty, investing in blue-chip stocks is a great way to add a layer of defense into a portfolio.

Blue-chip stocks are well-established companies with a long track record of successful business operations. Due to their proven nature, these stocks are typically much less volatile. In addition, they generally pay hefty dividends, another major perk for investors.

Three blue-chip stocks, Caterpillar CAT, Johnson & Johnson JNJ, and American Express AXP, would all provide investors with an extra layer of defense paired with solid dividend payouts.

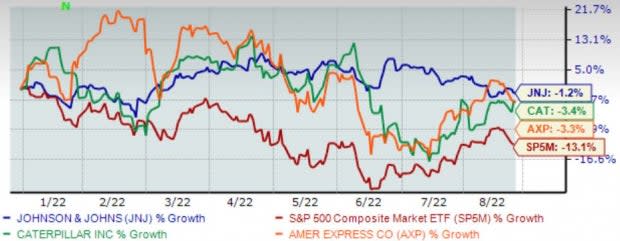

Below is a chart illustrating the share performance of all three companies year-to-date with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three companies’ shares have been much more defensive than the S&P 500 YTD, indicating that buyers have been busy all year long.

Let’s take a closer look at each company.

American Express

American Express AXP is a diversified financial services company offering charge and credit payment card products and travel-related services worldwide.

The company enjoys rewarding its shareholders via its annual dividend that yields 1.3%, just below the S&P 500’s annual yield of 1.4%. In addition, the company has increased its dividend payout four times over the last five years, with a five-year annualized dividend growth rate of a rock-solid 7.2%.

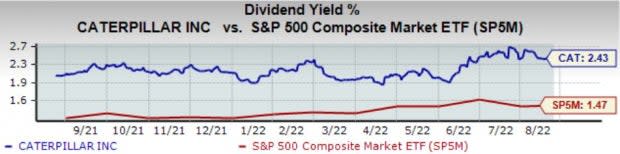

Image Source: Zacks Investment Research

Another major positive is the company’s growth – AXP is forecasted to generate a mighty $53 billion in revenue throughout its current fiscal year (FY22), reflecting a Y/Y change of 25%. And in FY23, the top-line looks to add an additional 12% of growth.

Image Source: Zacks Investment Research

American Express has also displayed stellar consistency within its bottom-line results, exceeding the Zacks Consensus EPS Estimate in 18 of its previous 20 quarters. Just in its latest print, the financial titan recorded an 8.4% bottom-line beat.

Caterpillar

Caterpillar CAT is the world’s largest construction-equipment manufacturer. The company designs, develops, engineers, manufactures, markets, and sells machinery, engines, financial products, and insurance to customers.

The company has proven itself as a big-time player in the market dedicated to rewarding its shareholders – CAT has impressively increased its dividend for 28 consecutive years, meeting the strict requirements to join the elite Dividend Aristocrat group.

Caterpillar’s annual dividend yields a sizable 2.4%, much higher than the S&P 500’s yield. In addition, the company’s payout ratio sits at a sustainable 39%, paired with a five-year annualized dividend growth rate of a notable 8.9%.

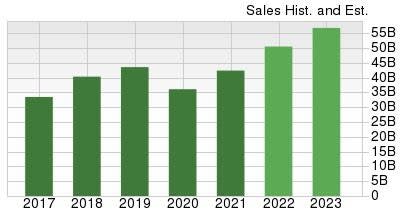

Image Source: Zacks Investment Research

Furthermore, revenue estimates allude to serious growth – the Zacks Consensus Sales Estimate for CAT’s current fiscal year (FY22) resides at $57.3 billion, reflecting a double-digit 12% Y/Y change. In FY23, the company’s top-line is projected to grow a further 6%.

Image Source: Zacks Investment Research

Impressively, Caterpillar has chained together nine consecutive bottom-line beats. Just in its latest print, the company exceeded the Zacks Consensus EPS Estimate of $3.00 by 6% and reported quarterly earnings of $3.18 per share.

Johnson & Johnson

Johnson & Johnson JNJ is an American multinational corporation that develops medical devices, pharmaceuticals, and consumer packaged goods.

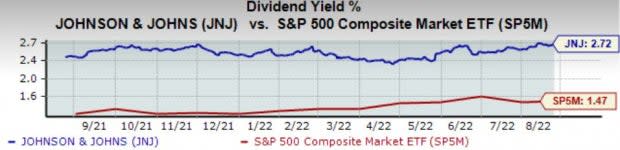

Speaking volumes about the well-established nature of the company, JNJ has increased its dividend for 60 consecutive years, making it not just a Dividend Aristocrat but a Dividend King as well.

The company’s annual dividend yields a sizable 2.7%, much higher than that of the S&P 500. In addition, JNJ carries a five-year annualized dividend growth rate of 6%, with its payout ratio sitting sustainably at 45% of earnings.

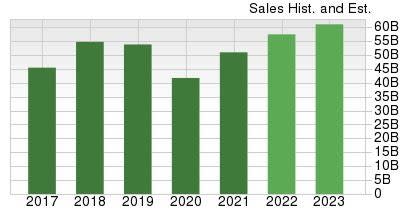

Image Source: Zacks Investment Research

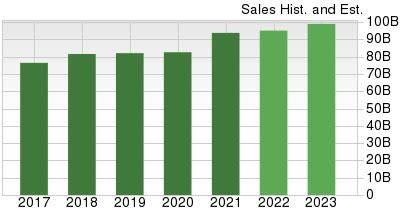

JNJ is forecasted to continue its growth trajectory – for the company’s current fiscal year (FY22), revenue is projected to reach a steep $95 billion, reflecting Y/Y growth of a respectable 1.5%. Looking ahead, JNJ’s top-line is forecasted to add an additional 4% of growth in FY23.

Image Source: Zacks Investment Research

Johnson & Johnson is the definition of consistency within its bottom-line results – the company has exceeded the Zacks Consensus EPS Estimate in each quarter dating all the way back into 2012. Just in its latest release, the company penciled in a 0.8% bottom-line beat.

Bottom Line

Investing in blue-chip stocks is a stellar way to shield yourself from volatility. In addition, they generally carry hefty dividend payouts paired with a track record of excellence within their quarterly reports.

With the market rolling over a bit in the recent term due to uncertainty surrounding the Fed, pivoting to companies such as Johnson & Johnson JNJ, Caterpillar CAT, and American Express AXP could prove to be a lucrative strategy that’d alleviate drawdowns in other assets that carry a higher risk level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research