3 Bank Stocks to Keep an Eye On as They Hit a New 52-Week High

Investors often use 52-week highs to pick an entry or exit point for a certain company. When a stock sets a new 52-week high, it signifies positive momentum and suggests that the price has been steadily growing over the last 52 weeks. This might attract more investors and traders who regard the stock as a great performer and want to ride the current rising trend.

Stocks that reach new 52-week highs are generally prone to profit-taking, resulting in pullbacks and trend reversals. Given the stock's high price, investors frequently ask if it is overvalued. While the speculation is not completely unfounded, not all companies that reach a 52-week high are expensive.

To avoid the high pricing, investors may miss out on top performers.

Major banks like Citigroup Inc. C, JPMorgan & Chase, Inc. JPM, and Bank of America Corporation BAC are expected to maintain their momentum and keep scaling new highs.

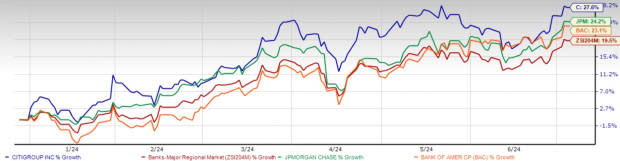

Year-to-date, all three stocks have outperformed the industry.

Image Source: Zacks Investment Research

To determine whether a stock has room for more upside, let’s delve deeper

What Cheered the Investors?

Before discussing the banks mentioned above, let’s discuss the factors driving these banks to scale at a new high.

An important contributing component to the positive aspects was the Federal Reserve's hint that interest rates will be cut later in 2024. While market players had expected the first rate cut to come in March, new economic data indicated that the central bank would hold off on raising rates until it had more evidence that inflation was abating. In September, the Fed is expected to lower interest rates for the first time since March 2020.

As the central bank kept the rates stable at 5.25-5.5% since July 2023, deposit costs are gradually stabilizing and even coming down for many lenders. Pressure on the net interest margin will likely decline eventually and will allow banks to have a stable/improving net interest income (NII).

Banks are also making efforts to diversify their revenue streams to reduce dependency on spread income. Lately, several banks are acquiring/forming partnerships to strengthen non-interest income. Banks are venturing into the lucrative private credit business to capitalize on the growing demand for alternative financing options.

These factors are driving investors’ confidence in banking stocks. Several banking stocks are touching new highs based on investors’ optimism.

Top Picks: More Upside to Continue

Citigroup: As a globally diversified financial services holding company, Citigroup continues to emphasize growth in core businesses through streamlining consumer banking operations globally. In June 2024, Citigroup completed the sale and migration of its onshore China-based consumer wealth portfolio to HSBC Bank China, a wholly-owned subsidiary of HSBC Holdings plc. The company is on track to separate its business in Mexico by the second half of 2024, followed by an IPO in 2025.

As part of the company’s broader strategy, it launched Citi Commercial Bank (“CCB”) in Japan to expand its commercial banking in key growth areas across certain clusters. This launch follows CCB’s introduction in France and Ireland in 2023, preceded by its launch in Germany, Switzerland and Canada in 2022.

Following the clearance of the 2024 stress test, C plans to raise its quarterly dividend by 6% to 56 cents per share. However, given the current challenging operating backdrop, the company ‘will continue to assess share repurchases on a quarter-to-quarter basis.’

The Zacks Consensus Estimate for C’s 2024 earnings has remained steady at $5.88 per share in the past seven days. The company surpassed the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 20.03%.

Citigroup crafted a 52-week high, touching $65.22 before closing the session at $64.46 on Jun 3.

JPMorgan: The largest U.S. bank, JPMorgan, is likely to gain from higher rates, loan growth, strategic acquisitions, business diversification efforts, strong liquidity position and initiatives to expand the branch network in new markets.

The bank keeps expanding its footprint in new regions. In February, the company announced plans to open more than 500 new branches by 2027. This initiative will solidify its position as the bank with the largest branch network and a presence in all 48 states in the United States.

JPMorgan continues to focus on acquiring the industry's best deposit franchise and strengthening its loan portfolio. As of Mar 31, 2024, the loans-to-deposit ratio was 54%. The company will be able to capitalize on its scale to record decent loan growth in the future.

JPM intends to increase its quarterly dividend for the second time this year as it cleared the 2024 stress test. The company plans to hike the dividend by 9% to $1.25 per share after announcing a 10% rise in March. JPM also authorized a new $30-billion share repurchase program, effective Jul 1, 2024.

The Zacks Consensus Estimate for JPM’s 2024 earnings has revised marginally upward to $16.50 per share in the past week. The company surpassed the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 12.31%.

JPM touched a 52-week high of $210.38 before closing the session at $208.69 on Jun 3.

Bank of America: One of the largest financial holding companies in the United States, Bank of America is expected to keep benefitting from the current high-rate regime and decent loan demand.

The bank embarked on an ambitious expansion plan to open financial centers in new and existing markets. By 2026, it plans to expand its financial center network into nine new markets. The bank is committed to providing modern and state-of-the-art financial centers through ongoing renovation and modernization projects.

Bank of America is focused on acquiring the industry's best deposit franchise and strengthening the loan portfolio. Despite a challenging operating environment, deposits and loan balances have remained solid in the past several years.

Following the clearance of the 2024 stress test, Bank of America intends to raise its quarterly dividend by 8.3% to 26 cents per share.

The Zacks Consensus Estimate for BAC’s 2024 earnings has been revised marginally upward to $3.24 per share in the past seven days. The company surpassed the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 62.8%.

BAC touched a 52-week high of $41.20 before closing the session at $40.90 on Jun 3.

Parting Thoughts

The three bank stocks — C, JPM and BAC — enjoy terrific growth prospects. They also have plenty of room to run even higher. Thus, investors must keep these stocks on their radar and wait for an attractive entry point.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report