2023 Rewind: Valuable Lessons (Part 2)

Though their styles may diverge, all legendary investors have one thing in common: they’ve been humbled more than once over their long careers, realizing that the key to long-term success is to constantly strive to learn more. As the late, great Charlie Munger once proclaimed, “Go to bed smarter than when you woke up.” In my effort to get smarter, I am using this light-volume holiday period to look back at the 2023 market and extract as many lessons as possible. Earlier this month, I wrote a piece titled “2023 Rewind: 5 Valuable Lessons.” Below is part two of the series:

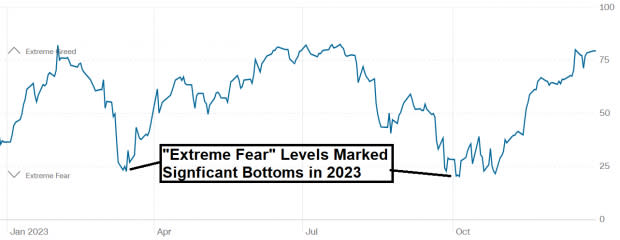

Extreme Sentiment Readings Mark Intermediate Turning Points

On Wall Street, it is crucial to "fade the crowd" and go against the market consensus by "zigging when they zag" for several reasons. The financial markets are driven by investors’ collective actions and sentiments, often resulting in herd behavior. When the crowd follows the same trend or investment strategy, it can create market inefficiencies and mispricing. Traders who can identify opportunities to deviate from the consensus and take contrarian positions can benefit from potential market corrections or reversals.

The CNN Fear and Greed Index quantifies investor sentiment by analyzing various market indicators to provide a snapshot of whether market participants are driven by fear or greed, helping investors gauge potential market conditions and sentiment extremes. The S&P 500 Index ETF (SPY) encountered two significant corrections in 2023. However, investors could have gained an edge by monitoring the Fear & Greed extremes in the market. Fear & Greed hit “Extreme Greed” levels twice in 2023, successfully marking each bottom in the market.

Image Source: CNN

Valuations are not a Timing Tool

Valuations, such as price-to-earnings ratios or other metrics provide insight into the relative attractiveness of an asset, but they are not precise timing tools. Market prices can deviate from intrinsic values for extended periods due to various factors, including investor sentiment, macroeconomic conditions, and market trends.

For example, in 2023, many investors perceived Nvidia (NVDA) as being “overvalued.” However, what retail investors failed to account for was that NVDA’s earnings were growing so fast that the company would “grow into them.” Furthermore, investors should understand that in bull markets, valuations expand, while in bear markets, they contract. Currently, equities are in a bull phase.

Image Source: Zacks Investment Research

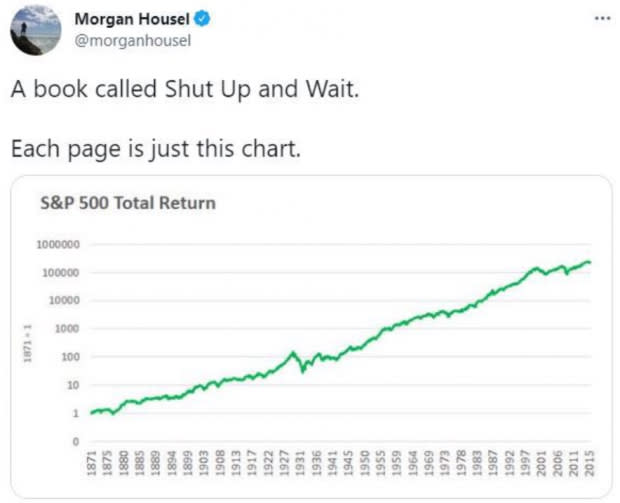

Stocks Rise Over Time

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” ~ Peter Lynch

Evidence supporting the quote above is relatively easy to find. A long-term chart of any major US index shows that price moves from the bottom left of the chart to the top right. In other words, over the long-term, markets rise. While bear markets are inevitable, investors with a “glass half full” mindset win in the long term.

Image Source: Morgan Housel

Bottom Line

I implore you to look back at 2023 with an open mind and study the price action. By coming up with your own lessons, you will set yourself up for future success.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

SPDR S&P 500 ETF (SPY): ETF Research Reports