2 Top-Ranked Cheap Growth Stocks to Buy in July and Hold

Wall Street is increasingly hopeful that Jay Powell and the Fed will start cutting rates in September to help ease pressure on the slowing U.S. economy. On top of that, the outlook for corporate earnings growth remains impressive for the second quarter and beyond.

There could be some broader profit-taking in the near term with the S&P 500 and the Nasdaq looking slightly overheated.

But investors likely want to keep buying stocks in July and the second half with the bulls seemingly in full control, fueled by projected rate cuts and stellar profit expansion.

The two stocks trading under $25 per share we dive into today boast strong growth outlooks and their improving earnings estimates help them land Zacks Rank #1 (Strong Buys).

Hims & Hers Health, Inc. (HIMS)

Hims & Hers Health, Inc. (HIMS) is a rapidly growing online health company that’s expanded from ED and hair loss treatments for men to an array of offerings across the broader health and wellness space for men and women. HIMS sells generic prescription medicines online and telehealth services across sexual health, skincare, mental health, and hair care for men and women. The online platform, which went public in 2021 via a SPAC, boasts nearly 2 million subscribers and hopes to gain steam in the hottest area of medicine: weight loss drugs.

Image Source: Zacks Investment Research

Hims & Hers announced in May the addition of compounded GLP-1 injections for eligible customers to “use medications with the same active ingredient as Ozempic® and Wegovy® without navigating the shortages and costs that are currently limiting access to the branded medications.” The compounded GLP-1 injections are part of its broader weight loss portfolio. HIMS is also slowly growing its non-prescription product sales to retailers through wholesale purchasing agreements, including deals with Target and others.

Hims & Hers grew its subscribers by 41% in Q1 to 1.7 million, helping HIMS boost sales by 46% and swing from an adjusted loss of -$0.05 a share to +$0.05. HIMS raised its full-year outlook due to impressive momentum and efficiency improvements, which helped “bolster” its confidence in reaching long-term Adjusted EBITDA margin goals of 20%-30%” vs. 12% in the first quarter.

Image Source: Zacks Investment Research

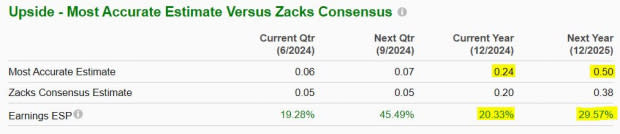

Zacks estimates call for Hims & Hers to grow its revenue by 44% in FY24 and add 31% to the top-line next year to climb from $872 million in FY23 to $1.64 billion in 2025. HIMS is projected to swing from a loss of -$0.11 a share last year to +$0.20 this year and nearly double its EPS in 2025.

HIMS stock has soared on the back of its improving EPS outlook, with its FY25 estimate up 533% during the last year. The upbeat EPS outlook helps Hims & Hers earn a Zacks Rank #1 (Strong Buy). And its most accurate/recent EPS estimate came in 20% above consensus for FY24 and 30% higher for FY25.

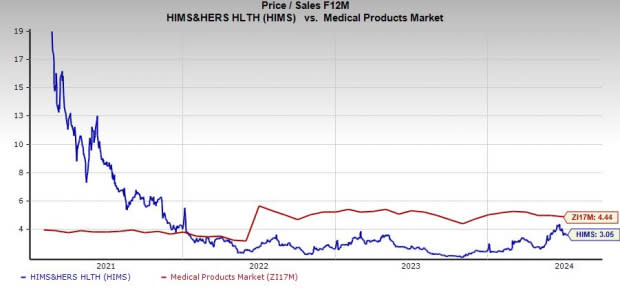

HIMS shares have climbed 125% in 2024 and 275% over the last two years vs. the Zacks Medical Products market’s -13% decline. Thankfully for investors who missed this run, Hims & Hers is down 20% from its June peaks at around $20 per share, after failing to break out above its initial post-IPO highs. HIMS could find support near its 50-day moving average with it back below neutral RSI levels.

Image Source: Zacks Investment Research

HIMS is trading at a 30% discount to the Medical Products space despite its huge outperformance and at an 80% discount to its highs at 3.1X forward 12-month sales. The online medicine firm has expanded rapidly without debt, sitting on $204 million in cash and equivalents and $448 million in total assets vs. $104 million in total liabilities.

Ero Copper Corp. (ERO)

Copper is an excellent conductor of electricity, helping it play an essential role in the global energy transition. Total global copper demand is projected to double by 2035, driven by the growth of alternative energy, massive infrastructure spending, EV expansion, and beyond. Copper prices have pulled back slightly from their recent highs, but Ero Copper stock is already on the comeback.

Image Source: Zacks Investment Research

Ero Copper is a Vancouver, B.C.-headquartered copper producer with mining operations across Brazil. The firm is coming off a solid stretch over the last several years and its growth outlook is robust.

Ero Copper aims to double its annual copper production by 2025, fueled by a new mining operation. The firm’s Tucumã Project is nearly 100% physically complete and it said last quarter it’s expected to “achieve first copper concentrate production in early Q3 2024.”

Ero Copper is projected to grow its revenue by 55% in 2024 and 49% in 2025 to soar from $427.5 million in 2023 to nearly $1 billion in FY25. Meanwhile, it is expected to expand its adjusted EPS by 95% in FY24 and 91% in FY25 from $0.87 a share last year to $3.24 per share in 2025. Ero’s earnings outlook has trended higher for FY24 and FY25 over the last several months, helping it grab a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

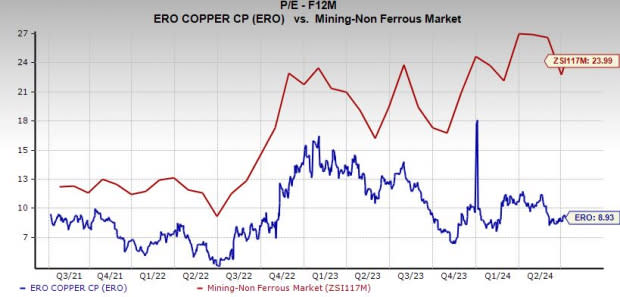

ERO shares have climbed 45% in 2024 to blow away its highly-ranked Mining-Non Ferrous industry’s 25%. Ero Copper trades 10% below its average Zacks price target. ERO is back above its 21-day and 50-day moving averages and it might be poised to break out to fresh all-time highs if its guidance impresses Wall Street on August 1.

Despite trading roughly 5% below highs, Ero Copper trades at a 63% discount to its industry and 50% below its peaks at 8.9X forward 12-month earnings.

The energy transition and rapid expansion of energy-intensive industries such as data centers and AI are fueling copper’s resurgence. Ero Copper could be a winning bet on the broader industry, offering the exciting combination of a low price per share (around $23), alongside big growth and value.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ero Copper Corp. (ERO) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report