13F Rundown: Tepper, Buffett, Druckenmiller

What is a 13F Disclosure?

A 13F disclosure is a quarterly report filed with the US Securities and Exchange Commission (SEC) by institutional investment managers managing at least $100 million in assets under management (AUM). The filing provides a detailed snapshot of their portfolio holdings, including stocks, options, and convertible securities. Investors pay close attention to this disclosure because it offers insights into the investment strategies of prominent fund managers. 13F disclosures are not a signal in itself but rather a means for building conviction in an industry or specific area of the market. Analyzing 13F filings can help individual investors by offering a glimpse into the thinking and positioning of successful money managers, potentially guiding their own investment decisions. Below are my three favorite 13Fs to follow:

David Tepper, Appaloosa

Takeaway: Bullish Big Tech

David Tepper is a billionaire hedge fund manager known for his successful bets on distressed companies. After the dust cleared from the Global Financial Crisis of 2008, he famously made his firm ~$7 billion by investing in beaten-down stocks such as Bank of America (BAC). With the proceeds, Tepper bought the NFL’s Carolina Panthers.

Tepper has one of the most bullish 13Fs on the street. Clearly, Tepper believes the strength in big-cap tech will continue. His top five positions include Nvidia (NVDA) (increased stake by 580%), Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN), and Alibaba (BABA). Because trends tend to last longer than most anticipate, Tepper’s bets make sense. Furthermore, despite its size, top-holding NVDA is slated to report eye-popping triple-digit earnings growth of 2245.85% in 2024!

Image Source: Zacks Investment Research

Warren Buffett, Berkshire Hathaway

Takeaway: Reducing Exposure (mainly old-economy value stocks), Remains Bullish AAPL

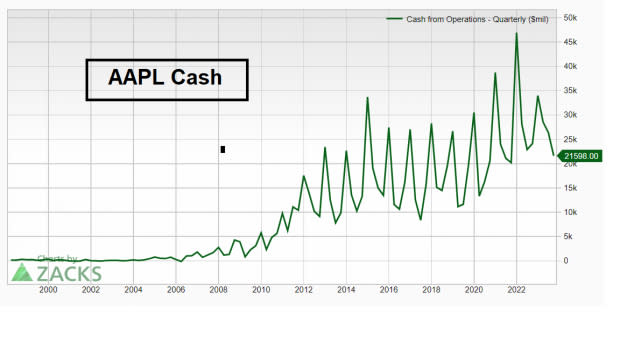

Warren Buffett needs little introduction. I like to follow Buffett’s portfolio because he has high conviction and low turnover – a winning combo for those looking to emulate a legend. In Q3, Buffett sold $7B worth of predominantly value stocks and exited names like General Motors (GM), Johnson and Johnson (JNJ), and Proctor and Gamble (PG). Unsurprisingly, Apple (AAPL) remains his largest position at a mind-blowing 50% allocation. Buffett famously loves cash-rich companies. Though Apple’s growth has slowed, it still has a hoard of cash on hand.

Image Source: Zacks Investment Research

Stanley Druckenmiller, Duquesne Capital Management

Takeaway: Bullish AI & eCommerce

Stan Druckenmiller is a highly successful investor who gained notoriety for “Breaking the Bank of England” with his then-mentor, George Soros. Across more than three decades of managing money, Druckenmiller has never registered a losing year. Druckenmiller’s top five positions include NVDA (reduced by 7%), Korean ecommerce company Coupang (CPNG), Microsoft (MSFT) (added 22%), Eli Lilly (LLY), and Teck Resources (TECK). Previously, Druckenmiller has compared the potential for AI to the internet, so it’s no surprise he is heavily weighted to the space. While Druckenmiller reduced his NVDA position, it remains his top holding, so it is likely that he remains bullish on the stock but is trading around a core position.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report

Coupang, Inc. (CPNG) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report